The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

Whilst no economics ‘expert’, it has become clear to Arkadian from evidence presented by organisations such as Positive Money and the New Economics Foundation that the UK Banking System is (i) rapidly driving us into a new Dark Age and (ii) not nearly as difficult to understand as those with a vested interest in it would have us believe.

As positive change depends on a general understanding, the current article aims to compare, in simple terms, how this system has worked in the past, and should work, and how it works currently to the detriment of you, your children, your community and your future.

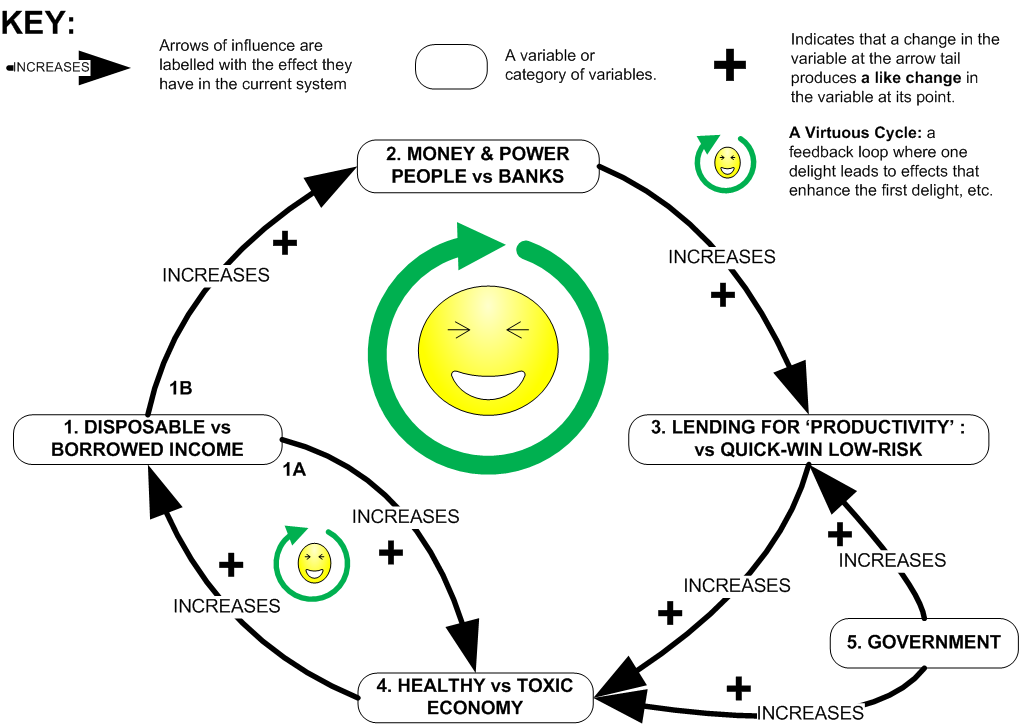

HOW IT WORKED (THE VIRTUOUS CIRCLE):

To begin, lets look at a diagram of how the UK economy worked in the years following WWII. At that time the country, as now, was stone broke but, unlike now, was driven by people-centred values sharpened in response to the Axis Power’s policies of dehumanisation. It is also a model of a ‘classic’ Capitalist System, as described by Adam Smith. Most people, and politicians, still mistakenly believe it works this way.

The arrows represent the flow of money, and the boxes: important ‘variables’ in the system. You can start anywhere, but it’s probably easiest to start with the box to the left.

1. Disposable vs Borrowed Income. You made a decent living in a secure job-for-life that allowed plenty of free time for friends and family. Your mortgage aside – which took around 10-15yrs max to pay off – you only bought things if and when you could afford them, thus putting money back into ‘circulation’ (arrow 1A). The remainder went into your savings account or share investments (arrow 1B) …

2. Money and Power: People vs Banks. …Banks were dependent on your savings to function as they were only permitted to lend in relation to their cash reserves. Their business worked by making money from the interest on these loans…

3. Lending for Productivity vs Quick-Win Low-Risk…As banks were still very much focused at a High Street level, much of their investment went into small businesses…

4. Healthy vs Toxic Economy…Thus your savings helped foster a growing, diversifying and stable local economy, which meant more secure jobs and, coming full circle, (1) more disposable income for other people to spend or save as well as a range of other social benefits associated with greater income equality.

5. Government, meanwhile, ‘governed’ the system to ensure it worked properly. In partnership with the Bank of England, they monitored the economy, periodically injecting new printed cash into the system to fill the ‘gap’ created by new growth, via public services that safeguarded citizens’ life dependencies (energy, social security, education, policing, health, telecoms, transport, postal service, military) and provided reliable employment for millions. They also regulated the banks to ensure they lent justly and responsibly.

And so it worked, by no means a well-oiled machine but still one guided by principles of fairness, general well-being, and economic restraint. So what’s changed?

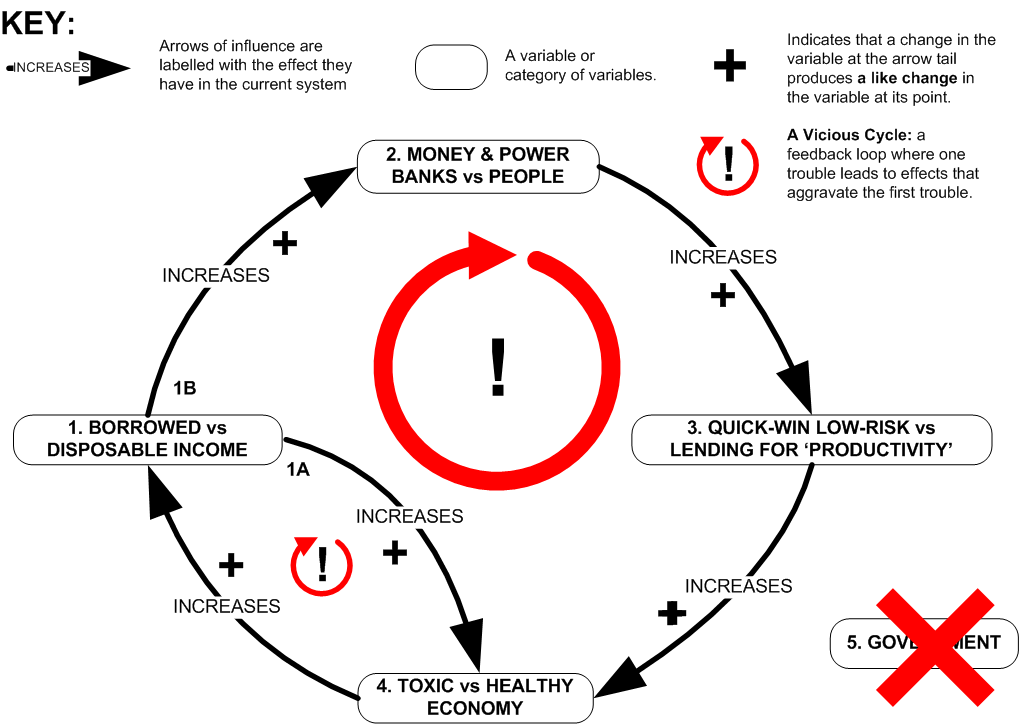

HOW IT WORKS NOW (THE VICIOUS CIRCLE).

1. Borrowed vs Disposable Income. Whilst you (unlike many) may still make a decent living, you and your partner work doubly-hard out of fear of losing your jobs and being unable to meet your mortgage and debt repayments.

In your absence, your children are raised largely by others. Even when you’re home, it’s tough to find energy for them when what you need is relaxation from the stresses and strains. The cost of a property sufficient to comfortably house your family has meant you’re probably destined to spend your whole life surviving on credit and without savings…

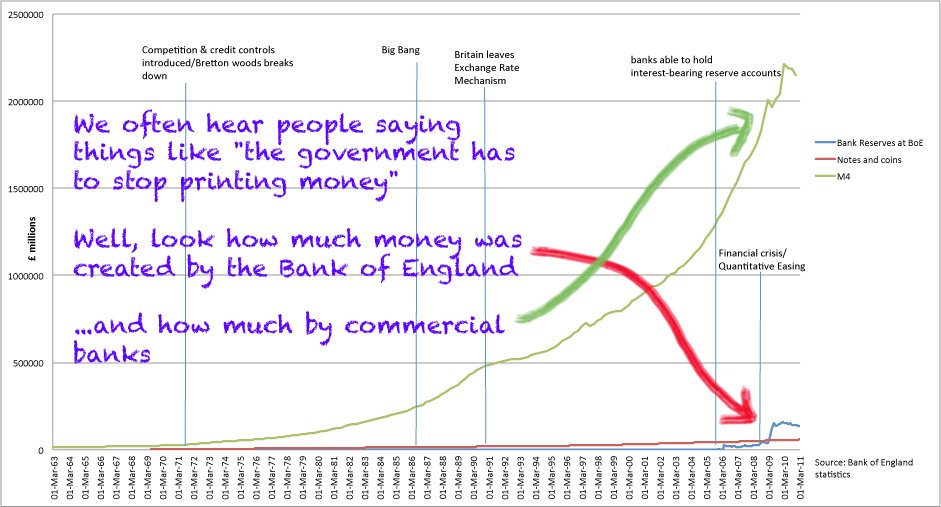

2. Money and Power: Banks vs People…But isn’t ‘no savings’ an issue for the banks? Not anymore! Now, when you need to borrow, they are free to tap the number into a spreadsheet and create it for you out of thin air, irrespective of the amount of ‘savings’ in their reserves (arrow 1B) . They also decide your interest rate: the ‘money-for-nothing’ (quite literally) from which they’ve grown rich, politically-powerful and monolithic…

3. Quick-Win Low-Risk vs Lending for Productivity…And these global giants no longer have time for long-term, high-risk investment, such as small or ‘ethical’ businesses. They plough your ‘interest’ into quick-win low-risk high-return investments, which are safely recoupable should anything go belly up.

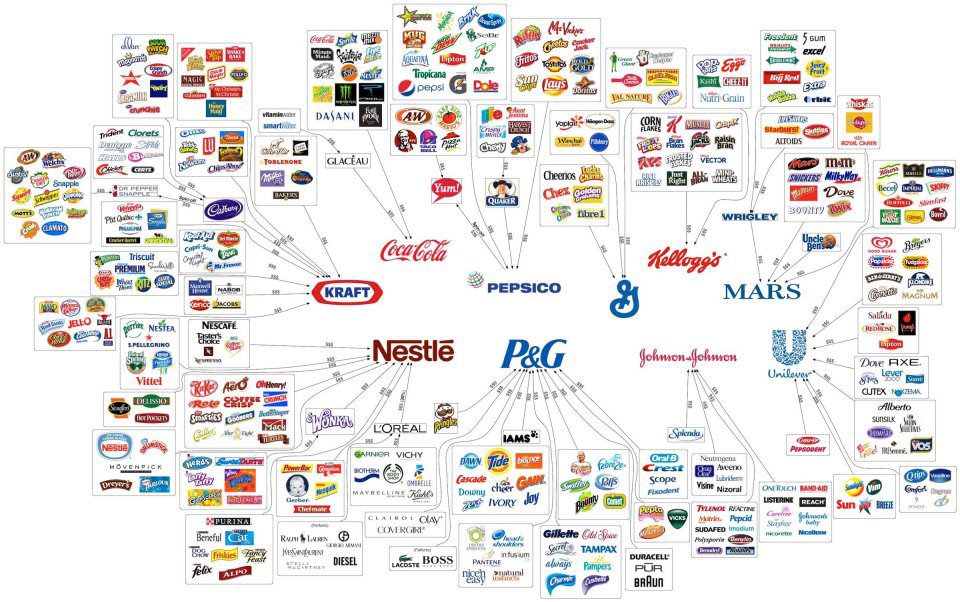

Around 90% goes int0 speculation, contributing virtually nothing to the economy, and, in the case of the food and currency markets, causing the suffering and deaths of millions in poorer countries. Much of the rest goes into property, and loans to big corporations that value short-term profit over the welfare of planet and people – fossil energy, mining, factory farming, mass media, consumer goods, processed food, the military etc.

4. Toxic vs Healthy Economy…Although in good times the economy appears to grow, growth no longer signifies health. Property prices inflate beyond the reach of many: notably, your descendants. Private monopolies supplant public services and local business, and we become increasingly dependent upon them for life essentials, employment, and a functional economy…

5. Government… So where are they in all this? Precisely! As mentioned in (2.), they’ve handed over the lion’s share of the responsibility for creating and managing the nation’s money to the financial sector. They’ve also permitted a few banks, and other monopolies, to grow so large and powerful that political success now hangs upon prioritising their interests over those of their electorate (with over half of Conservative Party funding now reliant on the banking sector and much of the remainder coming from defence, manufacturing and energy, is it any surprise that voter needs should come second to their sponsors’ return on their investment?) Whilst Whitehall may maintain the illusion of steering the British economy, technically they can’t because they’ve abdicated the controls.

And so the Vicious Circle turns, with each cycle the system becoming more unequal, uniform and unstable. There are three particularly vicious aspects of this system worth noting.

Firstly, it functions irrespective of recession. In boom, you borrow to get the things to which you aspire now rather than having to wait – using credit / store cards, bank loans, mortgages and the like – and the banks get rich and powerful. In bust, you borrow to make ends meet and the banks get rich and powerful.

Secondly, in a recession, because the vast majority of the money in the system is ‘borrowed’, to prioritise the repayment of the bank-invented debt (i.e. ‘Austerity’) over strategies for stimulating spending is guaranteed to shrink the economy further. Simply put, if pennies are taken out of the national purse and vanish into thin air without any being put back in, there will be less money in the purse. Unless, of course, we can find a bank to lend us a more.

Thus, whilst the historically-proven formula for economic recovery has always been to kickstart the Virtuous Circle through public spending and corporate regulation, in this sick misshapen world, crashes, austerity, privatisation and price hikes are great because they force us to borrow more, which indirectly results in new ‘imaginary’ money getting injected into the economy (arrow 1A).

And although a life of indebtedness for food, housing, clothes, education and so on, may promise an increasingly bleak existence for us and our children, for the environmentally-unconscious one-stop corporate shop that creates our credit, charges our interest, employs us as temps at the minimum wage, and is the only place where we can buy anything, it’s a field day.

Lastly, the unsustainability of this rampant money creation is largely irrelevant to the banks because, ultimately, the public debt is underwritten by the Bank of England, in other words, US! You, yes YOU, are effectively part-guarantor of everybody’s loan, including your own. The bubble will always burst, and more spectacularly each time, and it’ll always be you that is liable for the debt, never those that made billions from the recklessness.

Happily, fixing the system is remarkably simple. You have two choices. The easiest is to pick up the phone and (1) MOVE YOUR MONEY out of the Vicious Circle and into an ethical bank such as The Coop or Triodos, who maintain a responsible lending policy, consult you on your ideas for a better future and invest in them – organic farming, renewables, community development and so on – rather than whatever horror brings in the profits. Do it now and enjoy looking your children in the eye with a clear conscience!

(2) is to PUT PRESSURE ON YOUR GOVERNMENTAL SERVANTS to re-impose the vital framework that regulated the Virtuous Circle.

Most critically, this means returning the responsibility for money creation to The Bank of England. Exercise of this responsibility should involve the immediate injection of real cash into circulation (‘quantitative easing’) via investment in a growing public sector and green transition. This would reduce our economy’s toxic dependence on debt to function, generate employment and spending (the only way out of recession), and begin the change upon which a tolerable future hinges.

Close second, however, involves excising the corporate influence from our political system and allowing the democratic needs of citizens to determine Governmental decision-making, and not the insatiable greed of a small commercial oligarchy.

Thirdly, the ‘ecology’ of the financial sector should be regulated so that a significant percentage of banks are always focused on investment at the local level. This is the approach in Germany, and the greater diversity and stability of their banking system has enabled them to weather the present storm significantly better than most.

In short, if you wish to remain in a world where you are dependent on corporate monopolies for your existence, and where the conditions of your life and planet are certain to deteriorate, then sit back and do nothing. However, if you’d prefer a return to a financial system that works towards the common good then MOVE YOUR MONEY NOW!

A concluding thought: in The Early Middle Ages we were told the Bible was only comprehensible and communicable by The Church. It was a tale that, for a considerable time, maintained vision, interpretation, practice and power in the hands of an elite few.

Arguably, the translation of the Bible from Latin into English and its popular dissemination was one of the driving forces behind the development of the more market led and equitable society of later centuries. Knowledge, as they say, is power.

In the c21st our ‘mystery’ is The Economy, our priests: the politicians, economists and bankers. Pah! Economics is easy, isn’t it? It’s just about how we can make money work best for us and our loved ones.

So go on: inform your friends and family. Ask them to move their money too. It’s time to debunk the ‘priesthood’ and reclaim control over our lives, planet and future. Forever and ever. Amen!

Want to know more? Arkadian highly recommends following Positive Money or the New Economics Foundation on Facebook, or watching the illuminating video below. Learn and share!:

1 Comment

Leave a comment

Recent Posts

- Seeding a Viable Economic Alternative. Pt 3: Placing Mother Nature First

- Seeding a Viable Economic Alternative. Pt 4: Ego-as-Process

- Charlie Hebdo and the Immorality Loop

- My Top 20 Waterfalls Pt3 (S America: #2-1)

- My Top 20 Waterfalls Pt2 (S America: #7-3)

- My Top 20 Waterfalls Pt1 (Africa, Asia, Europe & N America)

- Positive Change using Biological Principles, Pt 4: Principles in Action

- Positive Change using Biological Principles Pt 3: Freedom from the Community Principle

- Positive Change using Biological Principles Pt 2: The missing Community Principle

- Positive Change using Biological Principles, Pt 1: The Campaign Complex

- Seeding a Viable Economic Alternative. Pt 2: The Principal Themes (Outcomes of a Systems Workshop at Future Connections 2012)

- Seeding a Viable Economic Alternative. Pt 1: The Action Plan (Outcomes of a Systems Workshop at Future Connections 2012)

- What I Learned from Destroying the Universe

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

- The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

- What is Occupy? Collective insights from a ‘Whole Systems’ Session with Occupy followers

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 2 of 5: Why does (did) Civilisation tend towards Diversity and Stability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?

Also peer to peer lending puts the parasitic banks entirely outside the loop

http://www.bbc.co.uk/news/business-18370777