What I Learned from Destroying the Universe

Happy New Year! Arkadian’s first blog of 2013 is a brief account of a recent, and surprisingly meaningful, personal experience of a natural system, and the important lessons learned.

Over the Christmas holidays, during a rainstorm, I took the dog for his usual walk in a local wood. En route there’s a place where I bridge a stream on a fallen tree trunk.

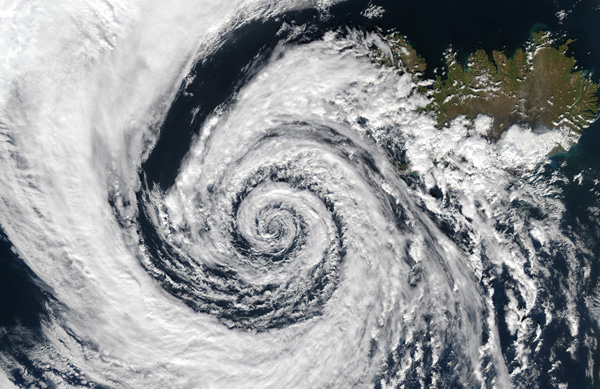

Halfway across, something caught my eye. Hovering above the swollen and fast-flowing water, was a perfect Giotto circle, white, saucer-sized. I got down on my belly for a closer look. It was an exquisite ‘universe’ of tiny bubbles, revolving clockwise peacefully, seemingly oblivious to the mayhem surrounding it (I didn’t have my cameraphone, so other ‘attractors’ this universe called to mind will have to be used instead for illustration. There is also a short video of a similar phenomenon at the end).

For 45 minutes I lay spellbound, trying to discern the dynamics underpinning its beautiful form and behaviour. Immediately, upstream a large rock, barely breaking the surface, split the current into three highly erratic patterns: a fast and a slow channel, and another that surged over the top in intermittent waves. These flowed either side of the universe and beneath it, respectively. Evidently, some eddy arising from their interaction was causing bubbles to organise as they did. But no matter how hard I studied, I couldn’t fathom how such chaos could have given birth to so elegant and serene an entity.

Eventually, my inner scientist could resist no longer. Reaching down, I put my little finger carefully onto the surface of the fast channel about a hand’s span from the edge of the universe. Pft! In a moment it disintegrated into a million bubbles, swept downstream on the torrent.

I waited a further 15 minutes, expecting the universe to reform. However, although random associations of bubbles coalesced from from time to time, none maintained location or integrity for more than a few seconds before being washed away.

The dog was palpably exasperated by this point, so we resumed our walk but returned for another look on the way home. Nothing. Most days since, I’ve passed this spot. Never have I seen the universe again.

So what three important lessons did I learn from destroying the universe?:

1. That no natural system is inevitable. Half of me still can’t accept that so robust a phenomenon could have been an accident. The little universe played a trick on my mind such that it seems inconceivable the specific environmental conditions in that area of the stream would never have given rise to it or will not again at some point in the future.

My other half, however, is now deeply humbled by a new certainty about uncertainty. The only reasonable conclusion it can draw from an honest review of the sporadic serendipitous coincidences by which a natural system, such as the universe, evolves from anarchic molecular storms, is that Fate and Destiny are tales told in hindsight. Nothing is meant to be. This half finds the thought oddly comforting.

2. That no natural system is independent of its wider environment. My intervention was based on a long and careful assessment of possible interrelationships between the universe’s behaviour and environment. I deemed the touch of my pinkie sufficiently gentle and distant from the core system to cause, at worst, a tiny perturbation that might afford some penetration of its workings.

But the universe depended on a context much wider and richer than I could have expected. Even within my narrow scope of observation, this singular micro-dance between pattern and (apparent) disorder defied any linguistic, mechanistic or mathematical generalisation.

That it also depended on the outlying point in the stream at which my finger interposed, however, drew my puny mind flailing into all the other dynamic factors vital to the universe’s becoming – the bubbles’ surface properties, the woodland shelter, the upstream topography, the rainfall intensity, the climatic pressure, and so on, inwards and outwards into a matrix of wholly interdependent and nested systems.

One can only quake in awe at the complexity, and in terror at the hubris of a culture that imagines it can reduce and conquer such prodigious abundance. The Modern Self thinks itself independent of its world and, thus, perceives the pieces of its world similarly: believing each can be treated in isolation. These are suicidal delusions it would do well to wake from.

3. That one shouldn’t be fooled by the apparent stability of a natural system. Although I never expected the universe to endure forever, its superficial calm, autonomy and resilience in relation to its riotous milieu communicated a permanence that would easily tolerate some interference. This was an illusion born from ignorance. The merest touch of my finger was all it took to disturb some hidden, fundamental control parameter, and initiate a total irreversible breakdown.

To summarise, it is my view that the universe was an impossibly fortuitous, complex, and mysterious accident (this includes my own ability to contemplate it). The illusion that I was separate from it, had mastery over it, and could assume its stability based on appearances alone was a recipe for disaster. The same assumptions likely hold for all natural systems, including the biosphere of the Earth.

What I learned from destroying the universe is that the wisest approach for humankind is to cultivate a new personal humility and responsibility towards the natural systems we experience every day: to intervene in their unique, context-specific lives with mindfulness and empathy, and to seek a partnership that follows their lead in all things. We have so much to learn.

We hope you’ll join us in a fortnight for our first major series for 2013: a model for seeding a nationwide viable alternative to the current economic system (co-created by a team of PhD candidates focusing on sustainable development).

*Since writing this blog, Arkadian came across a similar phenomenon in another stream, and this time took a video (see below). Whilst the current and context is radically more sedate, the behaviour is in many ways very similar to the instance described above and offers a good illustration.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

Welcome to the belated final installment of our five part analysis. We have been working towards the title’s conclusion by seeking an answer to the following question.

What difference between natural / social, and economic, systems causes one to tend towards diversity and stability, and the other, uniformity and instability?

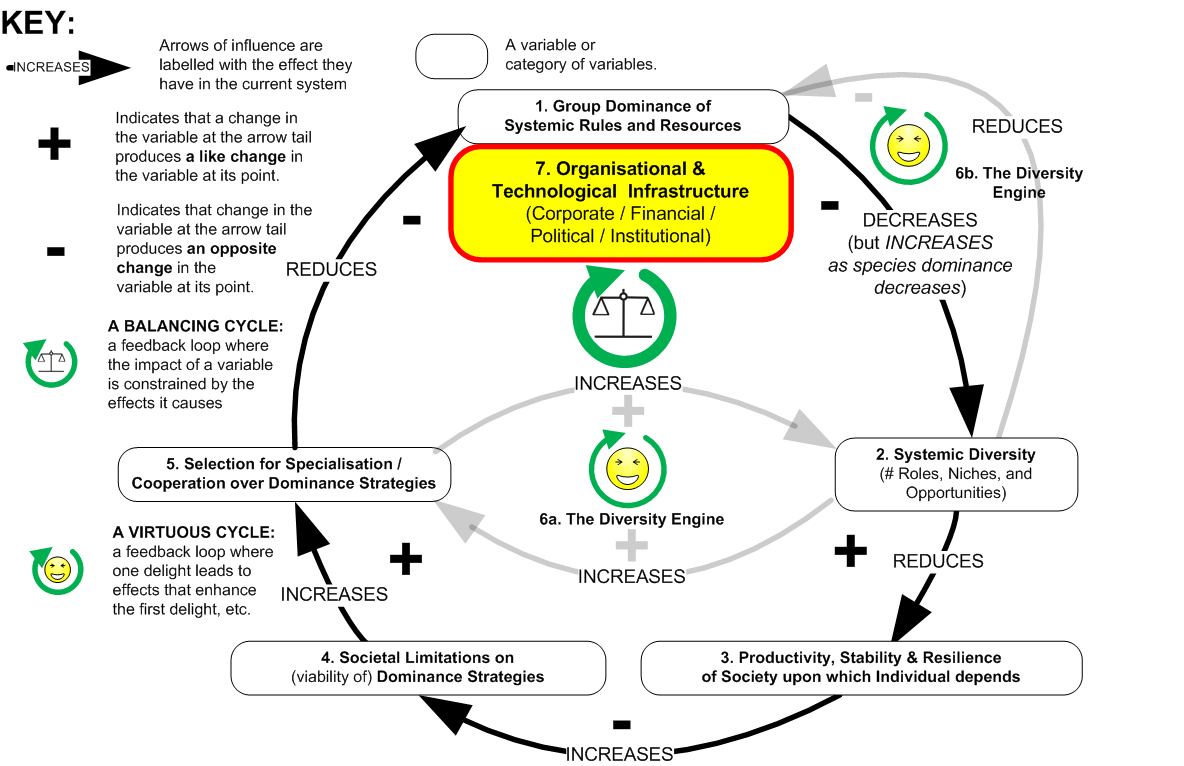

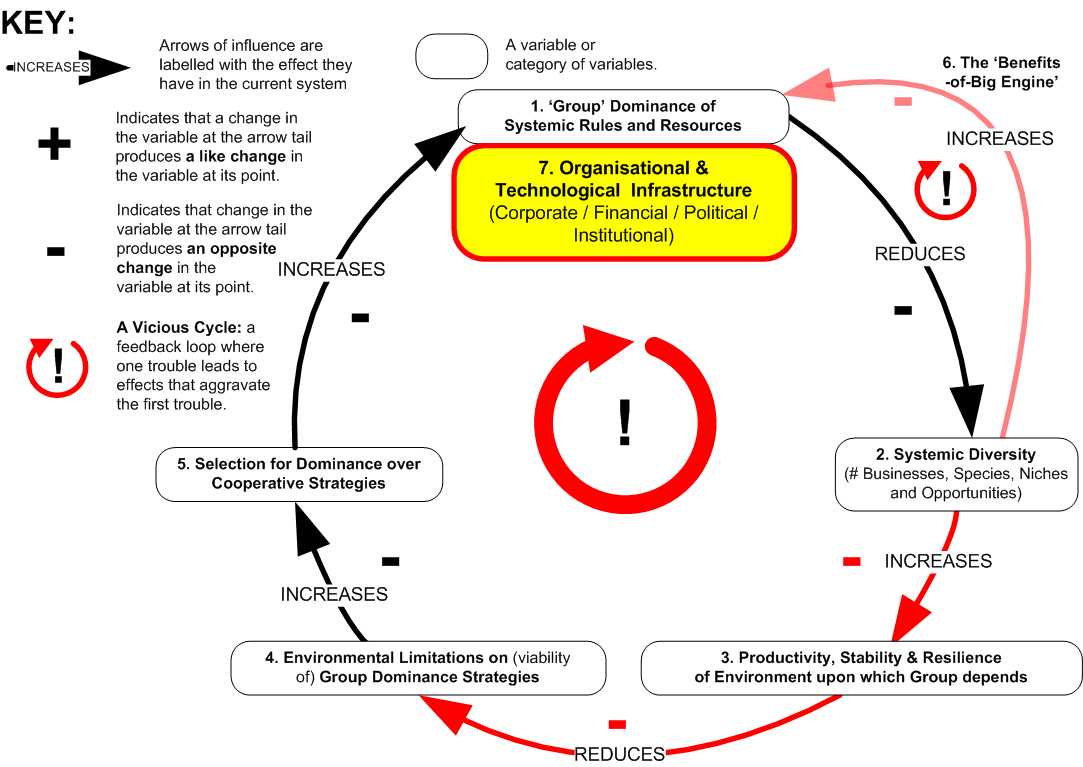

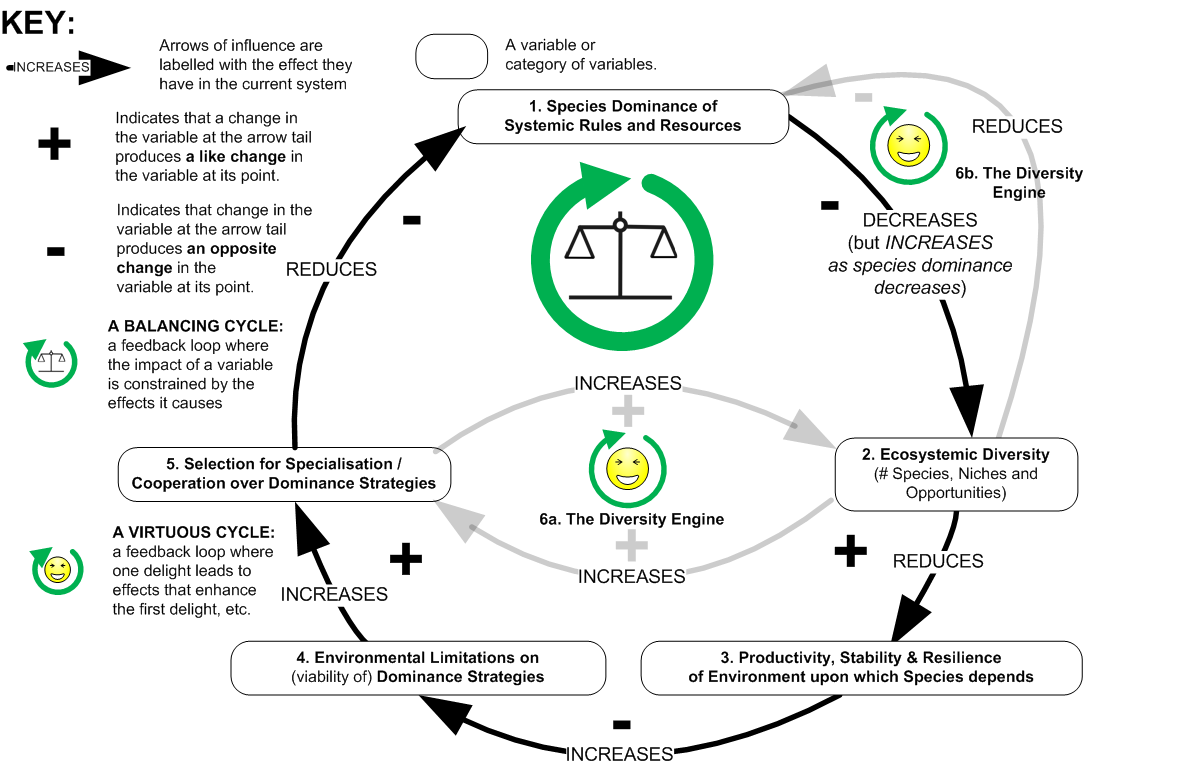

In installments 1, 2 and 3, we proposed that in natural / social systems a species or ‘group’ seeking total domination of their environment are constrained and, ultimately, destroyed by the impoverishing and destabilising effects of their actions on the systems upon which their own survival depends, thus leaving the arena open for dynamics that promote diversity and long-term stability (see previous installments if you need an explanation of the model below).

In installment 4 we suggested that the current economic system displays a reverse trend towards uniformity and instability because it allows the small ‘groups’ at the helms of corporations to gain increasing wealth and power from disintegrating social / natural systems without ever personally experiencing the environmental backlash of their actions. (see installment 4 if you need an explanation of the model below).

To clarify, this shouldn’t be taken as a demonisation of businessmen. Some individuals are naturally entrepreneurial, status-driven or materially-oriented, and the prosperity and order we have come to enjoy in recent centuries are largely indebted to their spirit and energy. Indeed, there are few among us that wouldn’t pass up a lottery win and the prestige, security and freedom it affords.

To clarify, this shouldn’t be taken as a demonisation of businessmen. Some individuals are naturally entrepreneurial, status-driven or materially-oriented, and the prosperity and order we have come to enjoy in recent centuries are largely indebted to their spirit and energy. Indeed, there are few among us that wouldn’t pass up a lottery win and the prestige, security and freedom it affords.

However, in the current era, unconstrained profit-and-power motivated vicious cycles represent a mortal threat to our freedom of choice, quality of life and, most urgently, our planet’s life systems. If the virtuous feedback mechanisms that promote diversity and stability in natural / social systems do not function naturally in the current economic system, then they they must be imposed artificially with due haste. But how?

First let’s summarise, in a nutshell, the problem to be resolved…

In the current economic system, dominant ‘groups’ are able to benefit from abusing the diversity and stability of socioenvironmental systems without ever experiencing negative feedback from their actions.

Although many possible interventions occurred to Arkadian whilst writing this series, a coherent regulatory model, which offered an unobjectionable, easy transition from the current economic system was not so easy to imagine (the reason why the final installment has been so long in coming!). Happily, a fully-formed (40yr old) solution presented itself recently in Chapter 19 of ‘Small is Beautiful’, courtesy of the genius of economist, E.F. Schumacher (pictured left).

The Schumacher Business Model, stated simply, rests on 2 systemic ‘tweaks’: (1) limiting the number of people a single corporate entity can employ and (2) introducing meaningful public ownership and accountability into business structure and practice.

(1) Legally restricting corporation size by number of employees. It would seem reasonable that a ceiling should be dictated chiefly by evidence regarding effective human group size (see Dunbar’s number), say between 80-200 persons. Growth beyond the upper limit, Schumacher suggests, should entail the formation of new independent corporate units, which may be linked by joint stock. These restrictions would enable each employee to ’embrace the idea of the business as a whole’ and the value of their role therein, but most importantly to the current argument, it would ensure that ‘the group (i.e. The Board)’ couldn’t claim ignorance of the details of their company activities and, thus, could reasonably be held personally accountable for abuses.

Furthermore, constraining size, particularly when the exploitation of natural / social resources is involved, is also more likely to physically ground a corporation in a local environment. Bringing ‘the group’ closer to their employees and the raw coal face of their realworld transactions is likely to increase their susceptibility and responsiveness to negative socioenvironmental feedback both internal and external to their organisation. It is also liable to curb the scale of impacts of which a single corporate vehicle is capable.

All very well, the cynics may cry, but what of the ‘groups’ with the thicker skins and thinner moral fibre?

(2) Public Ownership and Accountability. Schumacher advises we put an end to annual corporate taxation (a proposition not disagreeable to most businessmen!). In its place he proposes that for every share sold privately by a company, a further share is issued to the public. Thus, as owner of 50% of the company, we’d collectively receive half of any dividends if and when they are paid out to shareholders (he argues that when a company grows beyond a certain size it loses its ‘private and personal character’ and thus can be considered, in a sense, a public enterprise anyway).

To avoid disruption, our public equity wouldn’t allow us any voting rights in everyday business decision-making. It would, however, entitle us to attend Board meetings as an observer and, if the actions of the business were deemed to run counter to the public or environmental interest, we could apply to a court to get dormant voting rights activated.

To avoid disruption, our public equity wouldn’t allow us any voting rights in everyday business decision-making. It would, however, entitle us to attend Board meetings as an observer and, if the actions of the business were deemed to run counter to the public or environmental interest, we could apply to a court to get dormant voting rights activated.

To exercise these corporate responsibilities, Schumacher proposes the creation of independent citizen bodies funded from local business dividends. These ‘Social Councils’ would be split into four equal parts: three would have their members nominated by local trade unions, professional, and environmental, organisations, with the final quarter being drawn randomly from local residents in the manner of jury service. Involvement in management processes would, of course, be bound by strict confidentiality agreements.

Schumacher’s model brings socioenvironmental feedback directly into the Board room both as a ‘possibility in the background’ and, when necessary, as a real, prevailing constraint.

It is Arkadian’s prediction that, over time, exposing the ‘groups’ at the corporate helm to these balancing dynamics would drive a new trend towards macroeconomic diversity and stability, and greater corporate responsibility for the integrity of the natural environment (by triggering the ‘Diversity Engine’, described in installments 1, 2 and 3). And to top it all, it would require minimal design and economic / legal restructuring because, in the main, the model utilises existing frameworks and practices.

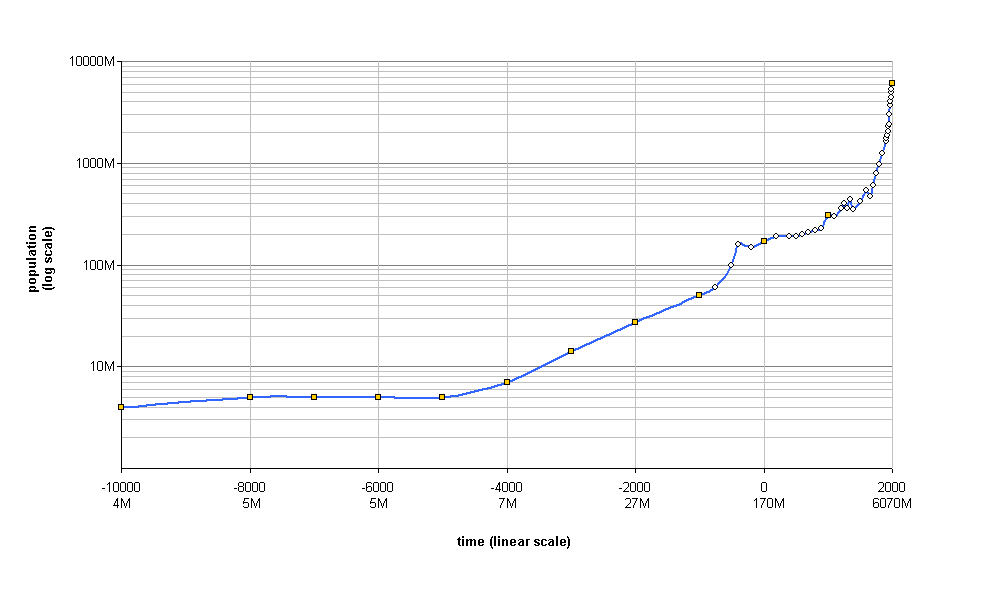

To conclude, effective corporate regulation is not just a Utopian nice-t0-have. It took till 1960 for World Population to hit 3bn. It has grown by 1bn approximately every 12yrs since, probably hitting the 7bn mark earlier this year. There are more human beings to house and feed today than have ever lived before. Presently, we have just over 2 acres of workable land each, 4x less than a century ago, and this is shrinking each moment as corporate activities and climate change destroy the natural world, and population continues to skyrocket.

Resultant biodiversity loss, whilst often second-ranked in current ‘problem’ trends is, as we’ve established, probably the most dangerous of all due to its inscrutable relationship with macroenvironmental instability. With extinctions currently at 1000x the background base rate, and predicted to rise to 10,000x over this century, we are very rapidly, and very blindly, removing the Jenga pieces of our life systems, largely for the sake of the short-term wealth creation of the small ‘groups’ of the corporate elite. History is littered with exemplars of total societal and environmental meltdown as the result of human impact on vulnerable ecosystems: Easter Island, The Mayans, The Pueblo Culture of the South Western USA, the Norse Greenland and Iceland colonies to name but a few. If we repeat the same mistakes globally, we may not get a second chance.

Resultant biodiversity loss, whilst often second-ranked in current ‘problem’ trends is, as we’ve established, probably the most dangerous of all due to its inscrutable relationship with macroenvironmental instability. With extinctions currently at 1000x the background base rate, and predicted to rise to 10,000x over this century, we are very rapidly, and very blindly, removing the Jenga pieces of our life systems, largely for the sake of the short-term wealth creation of the small ‘groups’ of the corporate elite. History is littered with exemplars of total societal and environmental meltdown as the result of human impact on vulnerable ecosystems: Easter Island, The Mayans, The Pueblo Culture of the South Western USA, the Norse Greenland and Iceland colonies to name but a few. If we repeat the same mistakes globally, we may not get a second chance.

Considering the twin pincers of population growth and biodiversity loss, it is quite evident that socioenvironmental stability and sustainability are our most important objectives for the c21st, bar none. Our very survival depends on achieving them and success is contingent upon economic and environmental policy which is underpinned by the principle of diversity=stability=good. If variety is both the spice and source of life, then we must put democratic pressure upon Government and business to make the small tweaks to our economic system necessary for it to produce abundance by its own workings.

For a fascinating and vitally important lesson in the importance of preserving and promoting biodiversity, Arkadian cannot recommend the video below more highly. Essential viewing for all inhabitants of Planet Earth.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

Welcome to the fourth and penultimate episode of a five-part Arkadian analysis which works towards the conclusion in the series title by seeking the answer to a simple question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In Weeks 1 and 2, we explored why ecosystems and ‘civilisations’ tend towards diversity and proposed virtuous dynamics (the ‘Diversity Engine’) that power increasingly fine-grained specialisation / cooperation, whilst inhibiting environmental dominance by particular species or social ‘groups’. Last Week, we looked at three examples at different ‘levels’ (social group, societal, global) which illustrated why overall systemic stability and resilience, and, thus, the common good, depends on a shared responsibility for productivity produced by this trend.

Today, we aim to get the crux of the issue at the heart of this series by investigating why the current global economic system behaves in the opposite way.

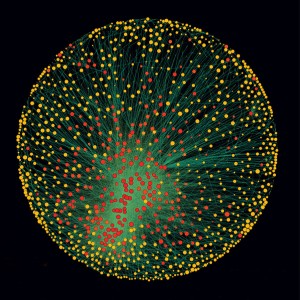

The last few decades have seen a dramatic global trend towards economic uniformity across most market sectors – most notably and worryingly, finance, media, food and agriculture, and manufacturing. A recent systems analysis by PLos One revealed that a network of 1318 companies directly represent a quarter of global operating revenues and, indirectly, via shareholdings in blue chips and manufacturing, a further 60%. Of these, a super-group of 147 companies, mostly financial institutions controls 40% of the total wealth in the system.

The last few decades have seen a dramatic global trend towards economic uniformity across most market sectors – most notably and worryingly, finance, media, food and agriculture, and manufacturing. A recent systems analysis by PLos One revealed that a network of 1318 companies directly represent a quarter of global operating revenues and, indirectly, via shareholdings in blue chips and manufacturing, a further 60%. Of these, a super-group of 147 companies, mostly financial institutions controls 40% of the total wealth in the system.

This homogeneity has also correlated with a spectacular increase in the scale and financial muscle of global corporations. A 2002 UNCTAD analysis, which used the sum of salaries and benefits, depreciation and amortization, and pre-tax income to compare firms with the GDP of countries, found that a third of the world’s 100 largest economic entities were transnational corporations. The biggest, Exxon, rivaled the economies of Chile or Pakistan; Philip Morris was on a par with Tunisia, Slovakia and Guatemala; and a more recent study research shows General Motors, DaimlerChrysler, Shell, and Sony to outsize Denmark, Poland, Venezuela, and Pakistan, respectively.

Many other corrosive trends have gone hand-in-hand with this expansion. According to statistics gathered by the New Economics Foundation, income inequality is now higher than at any other time in human history with the CEOs of the 365 biggest US companies earning over 500x that of the average employee. Corporate strategies to augment profits – outsourcing, temporary employment contracts, mechanisation and process efficiency – have eroded wages, job satisfaction and security, and human labour productivity, with the world’s biggest 200 transnationals now accounting for a third of world economic activity but employing less than 0.25% of the global workforce.

So what are the dynamics underpinning this pernicious trend? MODEL 3 of our analysis below proposes an answer (N.B. If you have trouble reading the text, click on the diagram to open it in a new browser tab and then refer back to the explanation here).

Whilst Model 3 involves more-or-less identical variables to the Models 1 (Ecosystems) and 2 (Civilisations) we explored in Weeks 1 and 2 respectively, there are several critical differences. Firstly, we broaden the definition of ‘diversity’ to include both socioeconomic and natural systems. Secondly, the term ‘group’ (which referred to political elites in Model 2) now refers specifically to the small alliance of people for whom a given corporation is a vehicle of wealth-creation: board executives, major shareholders, higher management and, to a lesser degree, senior employees, i.e. the people who don’t lose their jobs or bonuses during cutbacks.

Thirdly, and most fundamentally, is a change in the polarity of the two arrows (coloured red) connecting variables (2), (3) and (4). Unlike dominant species in ecosystems and ruling elites in political systems, these ‘groups’,empowered by (7) policy and infrastructure that enable vast geographical reach, promote their self-interest and shield them against personal accountability for abuses, are able to reduce systemic diversity without their actions having corresponding negative effects on the stability and resilience of their own local environment.

Thirdly, and most fundamentally, is a change in the polarity of the two arrows (coloured red) connecting variables (2), (3) and (4). Unlike dominant species in ecosystems and ruling elites in political systems, these ‘groups’,empowered by (7) policy and infrastructure that enable vast geographical reach, promote their self-interest and shield them against personal accountability for abuses, are able to reduce systemic diversity without their actions having corresponding negative effects on the stability and resilience of their own local environment.

Indeed, (3) the greater the ‘group’s’ impact on diversity, the more prosperous and secure their personal environment becomes. Thus, in the current economic system, (1, 4, 5 and 6) the drive for dominance of rules and resources is invigorated by growing wealth, social mobility and political influence, unlike ecosystems and civilisations, where it was curtailed by its weakening and destabilising impact on the environment And so it turns: not a Balancing Loop, but a Vicious Circle: a feedback loop where one trouble leads to effects that aggravate the first trouble, and so on.

To exacerbate problems, the absence of limiting environmental feedback also reverses the dynamics of the ‘Diversity Engine’, turning it into its ominous alter ego: a Vicious Circle we’ve named the (6) ‘Benefits-of-Big Engine’.

Here, instead of a trend towards economic diversity facilitating healthy competition and new business opportunities, and making market domination progressively more difficult, a small group of dominant players is able to harness ever greater resources, economies-of-scale and mechanisms of influence (price, lobbying, political office, advertising, media, academia) to overcome existing competition and render future challengers increasingly futile and improbable.

Disturbingly, whilst in nature / society the weaknesses and instability resulting from systemic impoverishment ultimately defeat the dominant species and ruling groups responsible, thereby facilitating a new order, in the current economic system they increasingly further the interests of the corporate ‘groups’ that have caused them.

These giants can downsize, buyout or price-out smaller floundering competition, and their huge economic significance means that, even if things get really bad, national governments are likely to intervene rather than risk the impact of bankruptcy. As touched upon in Week 2, the crisis-stricken financial sector is a perfect example, where after the panic of insolvencies, public bailouts and recession, a run of mergers and buyouts gave birth to a more monolithic, powerful and fragile banking system than ever before.

Possibly the darkest characteristic of ‘The Benefits of Big’, however, is that the larger and more ubiquitous these corporate vehicles become, and the more competitively priced their products and services, the more difficult it becomes for us to avoid participating in their expansionary activities.

Possibly the darkest characteristic of ‘The Benefits of Big’, however, is that the larger and more ubiquitous these corporate vehicles become, and the more competitively priced their products and services, the more difficult it becomes for us to avoid participating in their expansionary activities.

Thus, as customers, suppliers and employees, we all unknowingly or unwillingly, become complicit in dynamics that increasingly impoverish and endanger the systems upon which we depend.

In short, in the current economic system there appears to be no constraint on the wealth-creation of ‘groups’ at the helms of corporations other than a total socioenvironmental meltdown.

Happily, there is much we can do to change this. We hope you’ll join us next Friday for our final installment, when we shall use what we’ve learned from the virtuous ‘Diversity Engine’ of ecosystems / civilisations to propose interventions that could reverse the vicious ‘Benefits of Big Engine’ and create a self-sustaining economic system that benefits people and planet.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

Delighted that you’ve joined us for the third installment of our first Arkadian analysis for 2012, where over five short articles, we will show how we reached the series title’s conclusion by way of the following question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In Weeks 1 and 2, we investigated why ecosystems and ‘civilisation’ tend towards diversity and stability. It was proposed this was attributable to virtuous dynamics that promote long-term systemic stability and resilience by driving increasingly fine-grained specialisation / cooperation, whilst inhibiting environmental dominance by particular species or social ‘groups’.

Next week we will be putting forward an explanation as to why the current economic system displays the reverse trend but, for now, we thought it worthwhile to explain briefly the connection between diversity and stability. Why exactly does a change in the former result in a like change in the latter?

Put simply, in a diverse system, the health of the whole (‘productivity’) isn’t dependent on the performance of only a few parts.

For example, imagine a disadvantaged family where Dad is the only breadwinner. If he has an accident, no-one eats. If the house blows down in a storm, there’s no-one to rebuild it. Compare the situation with a second family where several other members also contribute to the household income. Because ‘productivity’ is distributed across several people, the overall family ‘system’ is much more able to adapt to an accident-prone Dad and / or a force majeure.

For example, imagine a disadvantaged family where Dad is the only breadwinner. If he has an accident, no-one eats. If the house blows down in a storm, there’s no-one to rebuild it. Compare the situation with a second family where several other members also contribute to the household income. Because ‘productivity’ is distributed across several people, the overall family ‘system’ is much more able to adapt to an accident-prone Dad and / or a force majeure.

A classic instance of systemic over-dependency at a macro-societal level is Ancient Egypt, which teetered on a single variable: the annual flooding of the Nile (taken from the excellent ‘Water’ by Steven Solomon). The ‘inundation‘, as it was known, rejuvenated the plains with fertile silt and washed away soil poisons, to produce the most self-sustaining and fertile farmlands of the ancient world.

A classic instance of systemic over-dependency at a macro-societal level is Ancient Egypt, which teetered on a single variable: the annual flooding of the Nile (taken from the excellent ‘Water’ by Steven Solomon). The ‘inundation‘, as it was known, rejuvenated the plains with fertile silt and washed away soil poisons, to produce the most self-sustaining and fertile farmlands of the ancient world.

The exclusive focus of the political elite was water management: senior priest-managers led departments for overseeing dikes, canal workers and measuring river levels; and top dog, Pharaoh’s, fundamental godly responsibility was mastery of the flow of the great river.

Unsurprisingly then, the Nile and Egyptian history ebb and flow in perfect synchronicity. Without exception, the Old, Middle, and New Kingdoms, as well as the later periods of Greek and Byzantine rule, bloom with the return of the regular cycle of flooding and crumple with climactic dry periods into centuries of disunity, chaos and foreign invasions. Thus, despite many environmental blessings, ultimately, the stability and resilience of this mighty civilisation and its elite were slave to the caprices of its one water source, in a way that a country with abundant springs, rivers and lakes could never be.

Our third and final example – the current economic downturn – illustrates uniformity and instability at a global level. Here, the world’s banking system was rendered so fragile by the interdependency of a few titanic banks and financial services firms, that massive external intervention was required to prevent total meltdown when one of them, Lehman Brothers, filed for bankruptcy in 2009. It is a crisis and an intervention for which we shall all suffer for many decades to come.

Our third and final example – the current economic downturn – illustrates uniformity and instability at a global level. Here, the world’s banking system was rendered so fragile by the interdependency of a few titanic banks and financial services firms, that massive external intervention was required to prevent total meltdown when one of them, Lehman Brothers, filed for bankruptcy in 2009. It is a crisis and an intervention for which we shall all suffer for many decades to come.

But why had the economic system not behaved like the natural / social systems we looked at in Weeks 1 and 2, and become increasingly diverse and stable as it expanded? We hope you’ll drop in next Friday to find out.

Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?

Happy New Year and welcome to our first Arkadian analysis of 2012. Over the next five weeks we will be working towards the conclusion of the title of the series by exploring the answer to a simple question: –

Happy New Year and welcome to our first Arkadian analysis of 2012. Over the next five weeks we will be working towards the conclusion of the title of the series by exploring the answer to a simple question: –

“What difference between natural / social systems and the current economic system causes the former to tend towards diversity and stability, and the latter, uniformity and instability?”

In a world where the latter now poses a mortal threat to the former, we considered this to be a question of some significance. Could we learn from the way natural / social systems self-regulate in a way that benefits all, to design an ecologically-and-socially-just economic system?

Our analysis will be set out in five short articles, launching Friday mornings throughout January and early February: –

(1) Why do Ecosystems tend towards Diversity and Stability? Friday 6th January 2012.

(2) Why does (did) Civilisation tend towards Diversity and Stability? Friday 13th January 2012.

(3) Why do Diverse Systems = Stable Systems? Friday 20th January 2012.

(4) Why does the Current Economic System tend towards Uniformity and Instability? Friday 27th January 2012.

(5) How do we create a Diverse and Stable Economic System? Friday 28th September 2012.

So without further ado, let’s move onto our first question of the series:

Why do Ecosystems tend towards Diversity and Stability?

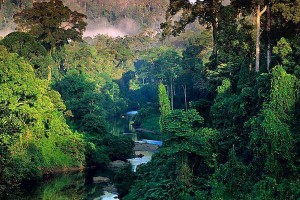

As a general rule the longer that ecosystems remain undisturbed by external factors, the richer they become. The oldest – the rainforests – are estimated to hold over half of all species, despite covering only 6% of the Earth’s surface. Why should 70m years of evolution against a backdrop of dynamic climate fluctuations give rise to increasing variety and not just a few dominant species?

MODEL 1 of our analysis below proposes an answer (N.B. If you have trouble reading the text, click on the diagram to open it in a new browser tab and then refer back to the explanation here).

Begin at the topmost variable and follow the arrows clockwise around the loop. (1) Put yourself in the position of a species that pursues total dominance over its local environment. (2) Despite considerable early successes, it’s not long before your manipulation and consumption begin to impact adversely on other species. (3) As local biodiversity diminishes, so too do the health, resilience and stability of the ecosystem as a whole, (4) resulting in ever-tighter constraints on your actions and, ultimately, the collapse of the environment upon which your own survival depends. (5) Your extinction kills off that suicidal gene that motivated your thirst for dominance, leaving an open stage for adaptive strategies that promote ecosystemic diversity and stability.

Begin at the topmost variable and follow the arrows clockwise around the loop. (1) Put yourself in the position of a species that pursues total dominance over its local environment. (2) Despite considerable early successes, it’s not long before your manipulation and consumption begin to impact adversely on other species. (3) As local biodiversity diminishes, so too do the health, resilience and stability of the ecosystem as a whole, (4) resulting in ever-tighter constraints on your actions and, ultimately, the collapse of the environment upon which your own survival depends. (5) Your extinction kills off that suicidal gene that motivated your thirst for dominance, leaving an open stage for adaptive strategies that promote ecosystemic diversity and stability.

Thus, coming full circle, (1) Your Environmental Dominance Strategy proved self-defeating because it led to Ecosystemic Weaknesses that constrained and, ultimately, negated, You! In Systems Dynamics a feedback loop like this where the impact of a variable is reduced by the effects it causes is called a ‘Balancing Circle’.

A further notable dynamic here is a pair of ‘Virtuous Circles’ (feedback loops where one delight leads to effects that enhance the first delight, and so on), which we’ve termed the ‘The Diversity Engine’.

A further notable dynamic here is a pair of ‘Virtuous Circles’ (feedback loops where one delight leads to effects that enhance the first delight, and so on), which we’ve termed the ‘The Diversity Engine’.

Here, (6a) the more the processes of natural selection incline towards interdependence, the more opportunities are opened up for new evolutionary adaptations. Thus, through increasingly fine-grained cooperation and specialisation between species, diversity itself drives diversity.

Moreover, as the environment grows ever more rich and complex, (6b) species dominance becomes increasingly futile and improbable, removing a further constraint on the trend towards diversity. And so both circles turn.

But (we hear you say) isn’t there a species that has had a radical effect on its local environment but has (thus far) escaped extinction? We hope you’ll drop in next Friday for Part 2, when we shall be exploring the curious exception of Homo Sapiens.

Recent Posts

- Seeding a Viable Economic Alternative. Pt 3: Placing Mother Nature First

- Seeding a Viable Economic Alternative. Pt 4: Ego-as-Process

- Charlie Hebdo and the Immorality Loop

- My Top 20 Waterfalls Pt3 (S America: #2-1)

- My Top 20 Waterfalls Pt2 (S America: #7-3)

- My Top 20 Waterfalls Pt1 (Africa, Asia, Europe & N America)

- Positive Change using Biological Principles, Pt 4: Principles in Action

- Positive Change using Biological Principles Pt 3: Freedom from the Community Principle

- Positive Change using Biological Principles Pt 2: The missing Community Principle

- Positive Change using Biological Principles, Pt 1: The Campaign Complex

- Seeding a Viable Economic Alternative. Pt 2: The Principal Themes (Outcomes of a Systems Workshop at Future Connections 2012)

- Seeding a Viable Economic Alternative. Pt 1: The Action Plan (Outcomes of a Systems Workshop at Future Connections 2012)

- What I Learned from Destroying the Universe

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 5 of 5: How do We Create a Diverse and Stable Economic System?

- The Root of all Evil: how the UK Banking System is ruining everything and how easily we can fix it.

- What is Occupy? Collective insights from a ‘Whole Systems’ Session with Occupy followers

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 4 of 5: Why does the current Economic System tend towards Uniformity and Instability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 3 of 5: Why does A Diverse System = A Stable System?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 2 of 5: Why does (did) Civilisation tend towards Diversity and Stability?

- Why Corporate Regulation is a Socioenvironmental Necessity. Part 1 of 5: Why do Ecosystems tend towards Diversity and Stability?